Business Banking Platform

Fast, secure, and convenient digital banking solutions for financial institutions to empower small businesses, planting the seeds for economic growth and societal diversity

Our Solutions

Onboard your clients and give access to the account through the virtual debit card in minutes, not days

Enhanced security, convenience, and control with virtual credit cards

Underwrite business loans

in minutes, not days

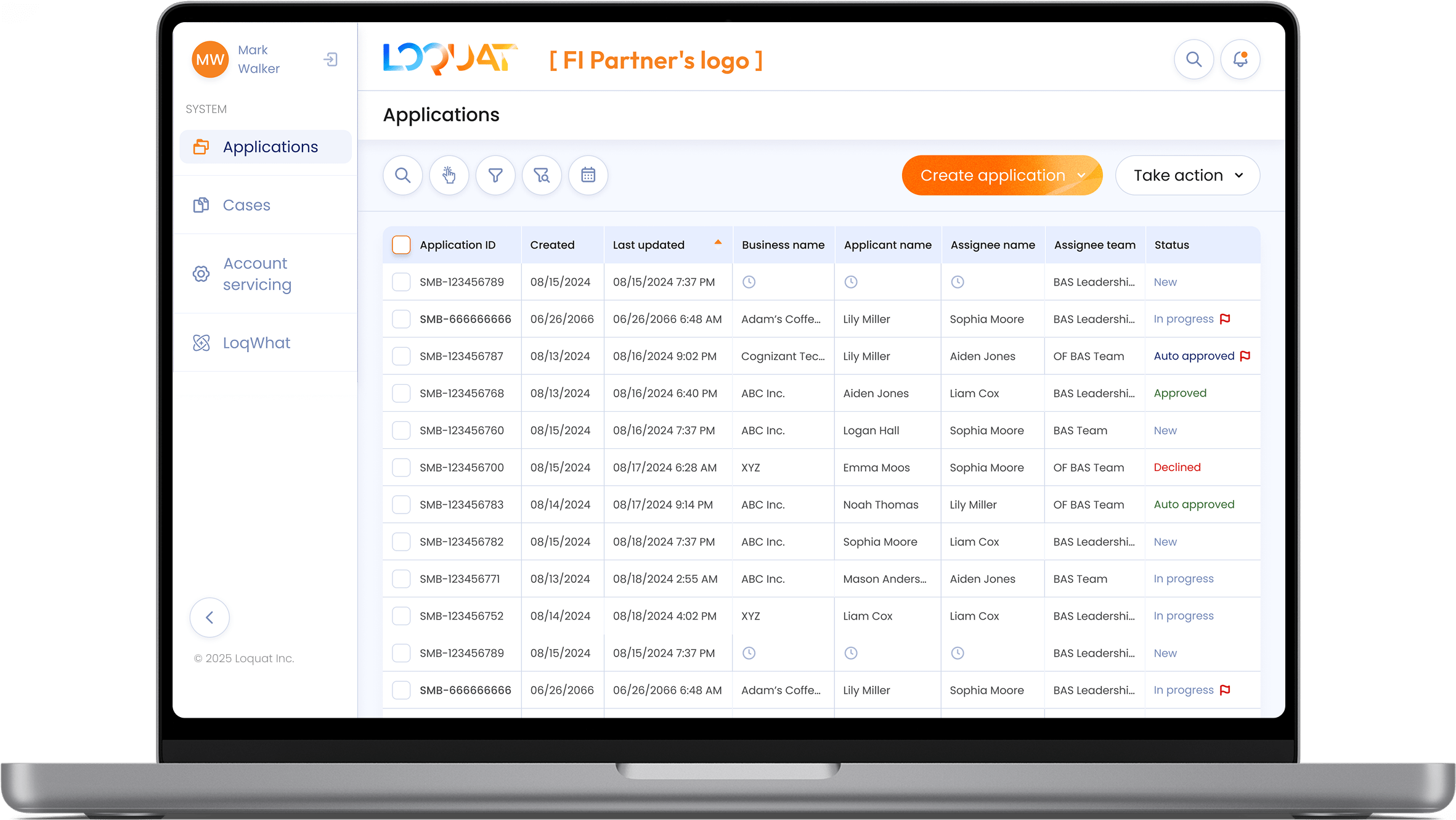

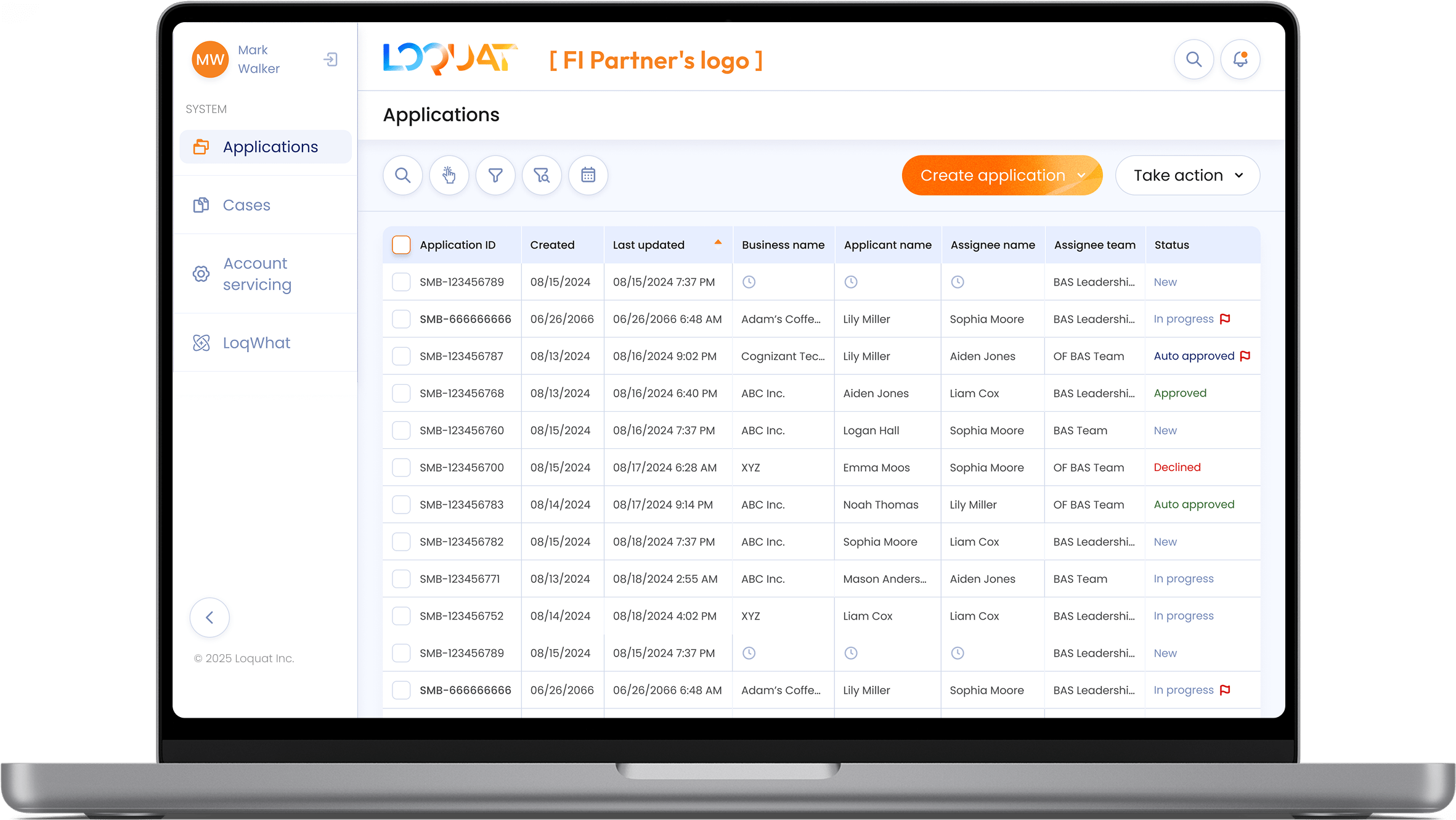

Track business applications in real time and access data analytics for the entire organization through one intuitive portal

Loquat Solution

Within minutes Loquat will authenticate and verify business owners and their businesses, so you can open their business accounts. Onboarding clients used to take weeks, now it takes minutes.

Customizable

Our tech, compliance, operations, and marketing experts are ready to put your unique touch on our platform

Loquat Solution

With us you can issue virtual cards designed for business instantly upon account opening for immediate access, enhanced eCommerce security and improved spending control

Loquat Solution

Within minutes Loquat will authenticate, verify and run proprietary ML scoring models, so you can underwrite business loans and disperse funds via a virtual card

Customizable

Your underwriting process is specific to your financial institution. We are ready to combine your unique approach and our platform

Loquat Solution

Track, manage, and gain insights for your organization via one intuitive portal

Start anywhere, resume anytime: Initiate applications on one device, continue on another or at a branch

Workforce

- Elevate workforce efficiency with our enhanced decision support capabilities built within the Loquat Platform

- Designed for streamlined approval, cost savings, and improved net promoter score (NPS)

Modular solution to accelerate SMB acquisition

- Digital Account Opening: Instant provision with automated verification

- Instant Digital Card Issue: Provide virtual cards to SMBs at account opening to expedite usage

- Intuitive Usage Analytics: Empower SMBs with insights on spend and account usage

Incorporates the latest in design aesthetics, ensuring a sophisticated interface combined with an intuitive user journey

- Leverage SMB rich data for informed decisions on upsell, cross-sell, and next-sell opportunities

- Access Loquat’s data-enriched digital underwriting capabilities to enhance your credit decision-making process

- Adaptable Architecture: Easily integrate with your existing infrastructure

- API-Driven Integration: Seamless connection

OurPartners

Every challenge we face is a wave shaping our skills.

August 14, 2025Buy now, pay later: A convenient lifeline or a looming debt trap?

August 13, 2025From legacy to leverage: Modernizing software engineering in banks

August 12, 2025The silent risks behind the tariff rally

August 11, 2025Feel good Sunday: The science behind great conversations

August 10, 2025Curious Saturday: The future of media

August 09, 2025Women’s sport is on a global winning streak

August 08, 2025Survive or thrive? How midsize banks can scale strategically

August 07, 2025The high-stakes balance: Interest rates, independence, and investor confidence

August 06, 2025Compliance without compromise: save 15–30% without sacrificing effectiveness

August 05, 2025New grads, fewer jobs: A cooling signal for the U.S. labor market

August 04, 2025Feel good Sunday: Moral imagination meets bold fintech leadership

August 03, 2025Curious Saturday: A solar pump that transformed a farm and a life

August 02, 2025How to futureproof your garden (Hint: think like a mushroom)

August 01, 2025

Business Members Can Now Onboard Online at America First Credit Union via Loquat

June 24, 2025

Loquat and Plaid partner to bring open banking to credit union and community bank customers

February 13, 2025

Loquat achieves SOC 2 Type 2 certification, strengthening data security and trust

January 07, 2025

Any Questions?

our FAQs

Loquat is purpose-built for financial institutions—such as community banks, credit unions, and regional banks—looking to enhance their digital banking offerings for both, consumers and business clients, while supercharging the employee experience, from branch employees to compliance teams. Loquat platform is built with a flexible and modular architecture to suit the specific needs of consumer or business clients.

Loquat’s end-to-end platform allows financial institutions to quickly launch or improve streamlined digital banking functionalities aimed at attracting either consumer or business clients, including new account onboarding, virtual and digital cards and payments; and lending capabilities, alongside our Client Application & Lifecycle Management (CALM) portal.

Loquat is currently available to financial institutions in the United States. However, international expansion is on our roadmap as we’re growing fast with multi-national deployment capability, so please stay tuned for future updates.

Our pricing model is aligned on growth and digital adoption. We typically have 3 components to our pricing, including (1) an enterprise integration fee, (2) an annual platform fee, (3) and transaction fees based on usage.

Focus and simplicity. Loquat is purpose-built for regional and community banks and credit unions, with a deep understanding of the regulatory, operational, and user experience challenges you face.

What truly sets us apart is the “easy factor” with a single integration, your financial institution can seamlessly onboard both consumer and business clients, enabling a unified experience that’s intuitive for users and efficient for your frontline staff. Our platform is built by experts in banking, compliance, legal, technology, and marketing—so every feature is intentional and aligned with how financial institutions actually work to provide an elite user experience for both your consumer and business clients as well as your employees.

Implementation timelines vary based on your financial institution’s current technical infrastructure and customization requirements, if any. Most integrations are completed within 3 to 6 months. Factors like the number of modules and the degree of customization requirements will influence the final timeline.

Getting started is easy. Schedule a discovery call with our team to explore your goals, evaluate fit, and begin your journey toward a more efficient and effective consumer and business-friendly digital banking experience.